Today Millennials have easy access to a number of online investing tools and mobile apps that make it easy for them to invest in stocks and/or cryptocurrencies.

So let’s review the M1 Finance investment platform and see how it measures up. A score of 10 being excellent, and 1 being the worst.

What does M1 Finance offer?

- Automated deposits

- Both individual stocks and ETF’s

- Can create multiple portfolio “pies”

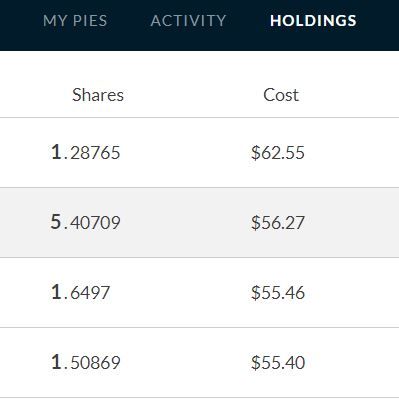

- Can invest in fractional shares

- Mobile app and website

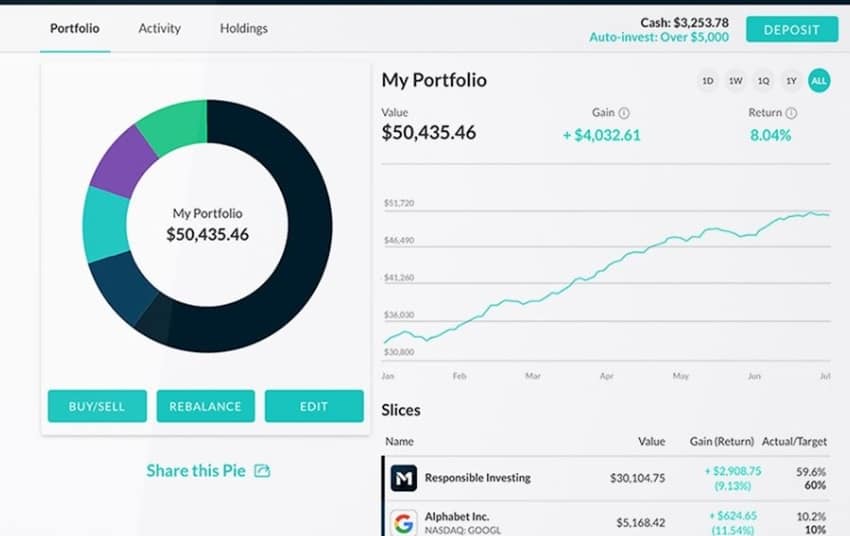

- Pie charts, graphs, nice UX

- Self-managed accounts

- Borrowing at a low 3% APR

- Smart re-balancing feature

- Zero fees to invest

My favorite features

Fractional shares

Most people want to invest in great companies like Google, Microsoft or Amazon. The problem is they don’t have enough cash to afford such expensive stocks.

A single share of Amazon (AMZN) costs over $3,000. Ouch. With M1 that’s no problem, because you can buy fractional shares, so you don’t need to cough up the entire share price, you can buy smaller fractions of a share. And if that share earns a dividend, then you can also receive fractional dividends. How nice is that.

Portfolio pies

The investment portfolio pies on the M1 platform are pretty slick. You can add up to 100 slices (stocks, to each individual pie), you can also add pies inside of pies. For example, if you decide to create 4 pies specific to individual sectors, and then if you want each of those pies to take up 25% of a main pie, you can totally do that.

You can even share your pies with other investors via a sharable link. You can download pies from professional investment firms and literally copy their investment strategies if you want, or you can create a completely custom pie of your own.

Retirement accounts

Many people keep their retirement account in a 401k. This is actually a terrible idea unless your employer is giving you a percentage match on your 401k, because in that case at least you are getting something for free.

It’s generally a bad idea because most brokerages will quietly steal from your 401k though mismanagement of your assets, penalties or by way of fees.

Fees of only 1% can slash the value of your savings [or retirement] by 28% over the next 35 years.

US Dept of Labor

On M1 Finance however, you can transfer your 401k (by converting it to an IRA) and then you never have to pay any more fees on it again. I did this, and I love being able to quickly see the value of my retirement account from my phone at any time, and having the ability to easily self-manage it at any time/anywhere is an additional bonus.

Are there fees?

Nope! Unlike the Acorns/Stash investing apps, on M1 there are no fees when you buy/sell/deposit or withdraw funds.

The entire platform is free for individual investors. There are no trading commissions, no account maintenance fees, and no charges for deposits and withdrawals.

Quoted from cashcowcouple.com

You might be wondering, “Then how do they make money?” If you desire to know, you can find the answer to that question here. I love the fact that they are very open and transparent.

Missed opportunity

The “transfers” tab is a super nice addition to M1 Finance mobile app. It allows you easy access to deposits/withdrawals, etc. Basically maintain all transfers, in and out of your investment account from one convenient location.

So you can do automated deposits and auto investing which is good, but I think not having the ability to do auto withdrawals on dividends is unfortunately a big missed opportunity. For example, perhaps under the transfers tab, add icons for: reinvest dividends | keep dividends in cash account | auto withdraw dividends to external bank account. If they added this, it would be a godsend.

Overall Rating: 8/10

Overall, I think M1 Finance is awesome. The more I use M1 Finance to invest, the more I enjoy it. Being able to self-invest your own money (without fees) is very liberating.

Perhaps someday they might also include decimal points in the pie slices though, for example if I wanted a pie with 15 items divided evenly you can’t do it without inserting something like 6.66666% in each slice. Currently the pie slices must all be whole numbers that total up to 100, so you cannot use decimals. But this is a very minor setback.

I’m loving this app and you guys might want to to try them out. (Minimum is $100 to start and then you can invest whatever amounts you want) This way you can decide if you like them or not.

If you guys decide to sign up, use my promo code so we both get $10 bucks for free. What do you think about M1 Finance? Do you love it or hate it? Leave your thoughts in the comments below!

Disclaimer: This article was written for educational and entertainment purposes only. This is NOT financial advice. Always do your own research and please consult with a licensed attorney before making any serious investment. We are not responsible for any investment decisions that you choose to make.